Google Ad spend grows despite AI changes

Search and shopping ads and PMax adoption remain strong as well as stable CPC growth, according to a new Tinuiti report.

Anu Adegbola on October 29, 2024 at 10:11 am | Reading time: 2 minutes

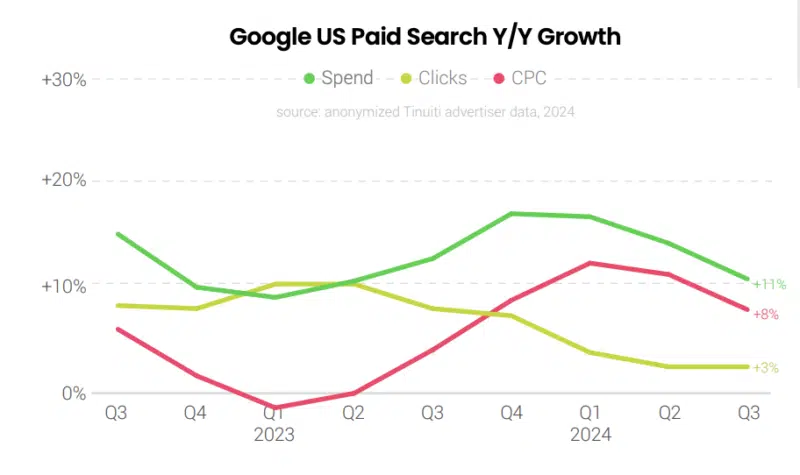

Google search advertising spending rose 11% year-over-year in Q3 2024, showing resilience despite slower pricing growth and the introduction of AI-powered features according to Tinuiti’s latest Digital Ads Benchmark Report.

Overall performance.

- Google search ad spending grew 11% YoY in Q3 2024, decelerating from 14% growth in Q2.

- Click growth remained stable at approximately 3% YoY.

- Cost-per-click (CPC) growth moderated to 8% YoY, down from 12% in Q2.

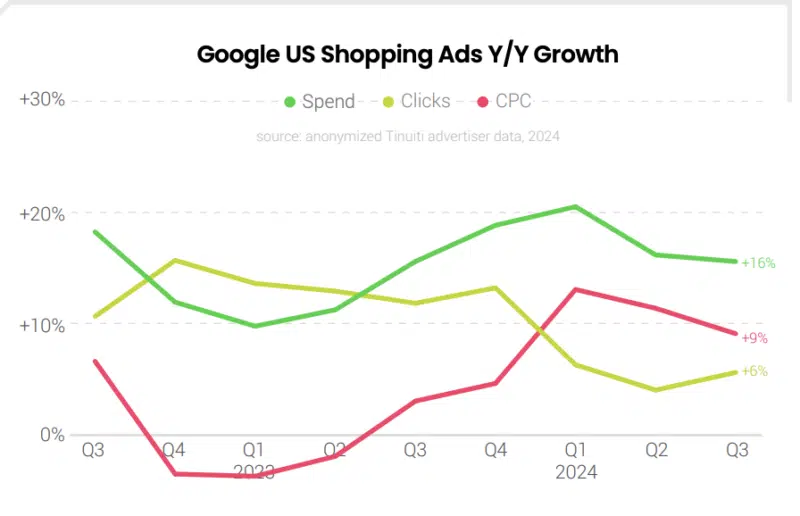

Shopping Ad momentum.

- Shopping ad spend maintained strong 16% YoY growth in Q3, matching Q2 performance.

- Click volume improved to 6% YoY growth, up from 4% in Q2.

- Shopping CPC growth decelerated to 9% YoY, continuing a downward trend.

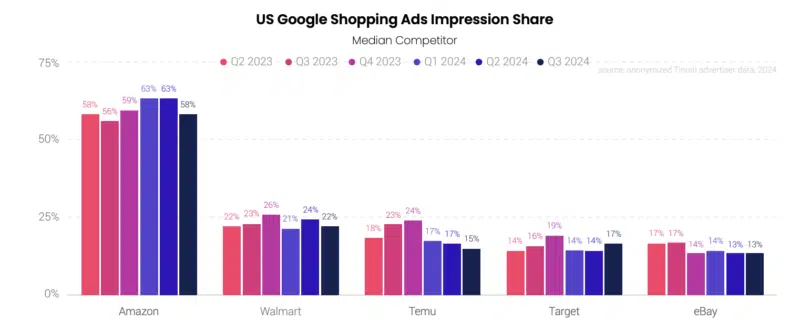

Competitive landscape.

- Amazon dominates shopping ad impressions with 58% share in Q3, though down from 63% in Q2.

- Notable mid-September dip to 45% share before quick recovery.

- Walmart holds a distant second position with 22% share.

- Temu’s presence declined significantly compared to 2023.

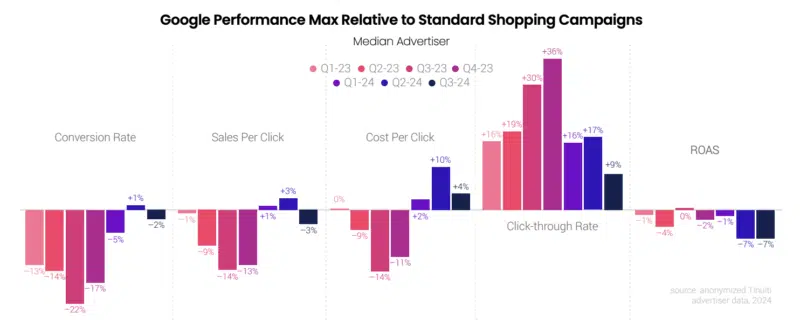

Performance Max (PMax) trends.

- 92% adoption rate among shopping advertisers in Q3, up 1 point from Q2.

- Non-shopping inventory reached 29% of PMax spend in September, up from 21% in June.

- YouTube contributed just 1% of PMax placement impressions.

- Mobile apps maintained steady 10% share of impressions.

Campaign performance metrics.

- PMax conversion rates fell 2% below standard Shopping campaigns in Q3.

- PMax sales per click shifted from +3% to -3% versus standard campaigns.

- Return on ad spend (ROAS) remained stable quarter-over-quarter.

- Traditional text ad spending grew 7% YoY, down from 13% in Q2.

Impact of Google AI Overviews.

- Mobile non-branded keywords saw 14% CTR decline from April to July.

- CTR recovered in August and September across segments.

- Non-brand mobile CTR remains 4% below April levels but 6% above early 2023.

- Shopping ad CTR rose 14% on mobile between April and September.

Why we care. The data suggests that while Google’s AI Overviews initially impacted ad performance, advertisers are adapting and finding ways to maintain growth, particularly through shopping ads and Performance Max campaigns.

Key takeaways.

- Shopping ads demonstrate resilience amid broader market changes.

- PMax adoption remains high despite slight performance deterioration.

- Major retailers maintain dominant positions in shopping ad impressions.

- Google AI Overviews impact appears to be stabilizing.

- Mobile continues to be a critical battleground for ad performance.

The report. Tinuiti’s Q3 2024 Digital Ads Benchmark Report.

Related stories

New on Search Engine Land